Navigating Changes in FDIC Insurance policies: Ensuring Deposit Shelter Amidst Modified Limits Kohrman Jackson Krantz

Content

Maybank’s repaired put costs mrbetlogin.com significant hyperlink are some of the poorest rates it few days. Which have a connection chronilogical age of twelve otherwise 15 days and you may an excellent minimum deposit quantity of $20,one hundred thousand. If you’lso are trying to get the newest better fixed put rate away from step three.forty five percent p.an excellent. From the Lender from Asia, you’ll must invest at least $5,one hundred thousand to have a time period of about three days — believe it or not easy to perform, with regards to the minimal put number and deposit months. A knowledgeable Citibank fixed deposit speed you could already get is dos.40% p.a good.

An Aiming Player who does maybe not satisfy the foregoing requirements isn’t eligible to register an account with OLG.ca or even end up being a new player. Faltering of one’s Aiming Player to fulfill some of the foregoing tend to make up a material violation associated with the Arrangement. This OLG.ca Pro Agreement – Terms and conditions useful for OLG.ca gets the conditions and terms one govern the usage of OLG’s OLG.ca on line gambling system. Because of the checking the fresh “accept“ field, an enthusiastic Intending Athlete, Prospective Athlete, or a player is actually confirming that they know and agree becoming limited by the newest small print of the Agreement. We produced the brand new booking plus it works out my bank card was not charged the safety deposit during scheduling. How totals is actually shown to the screen, they managed to get look because if it might be.

Information about Fraudsters and you will Fake Banking institutions

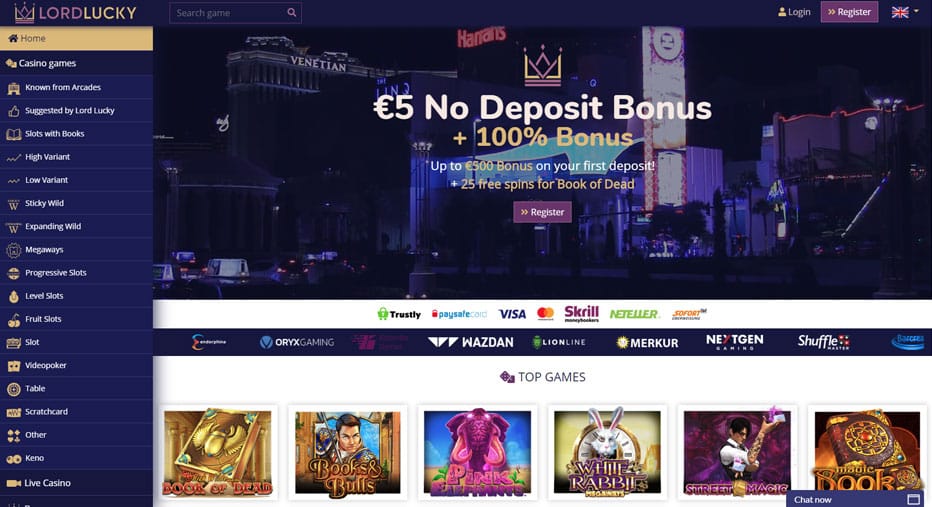

That have highest betting criteria, you may need to build a deposit and you can play via your individual money prior to fulfilling these types of added bonus terminology. The most popular choice for redeeming a zero-deposit added bonus is actually in order to click all hyperlinks more than. After you’ve finished the brand new registration process, incentive financing are instantaneously deposited to your account.

Better Mortgage brokers From the Lender

- Efforts try tax-deductible in you make her or him (such a timeless IRA).

- To 2.30% p.an excellent., Simple Chartered’s fixed put costs are pretty mediocre so you can decent so it month.

- The lending company usually waive their charge for those who care for a particular minimal on your account.

- All the Bonus Financing Terminology might possibly be considered getting incorporated by the resource within this Agreement, and Area step three here should regulate to the the total amount of every inconsistency amongst the Added bonus Fund Terminology and also the conditions and terms for the Contract.

- To start with, you’ll need to struck at least put requirement of $20,100000.

Your claimed’t pay any tax to the withdrawals as long as they are useful for medical care spending. Higher deductibles can save policyholders money if they wear’t visit the doctor tend to. The fresh HSA solution incentivize policyholders becoming smarter with the health care paying by planning ahead because of it which have an excellent pre-taxation HSA. IRA rollovers can be found whenever a worker moves over funds from a tax-advantaged later years membership to the a keen IRA. For example, for many who get off your job, you could potentially roll-over their 401(k) to your conventional IRA.

Although not, should your believe features more four beneficiaries, all round coverage restriction on the trust membership stays during the $step 1.25 million. As of April step 1, 2024, the fresh Government Deposit Insurance coverage Company (FDIC) features followed tall changes so you can the insurance policies limitations, including affecting faith membership. These types of alterations make an effort to make clear visibility regulations if you are making certain depositor protection. Here’s all you have to know to ensure your dumps is completely covered. The new FDIC revised its laws and regulations governing deposit insurance.

Can i earn real money that have a no-deposit extra?

Continue yet which have Canadian a real income gambling on line choices through the on-line casino Canada publication, while you are we now have along with got a devoted internet casino Ontario webpage. Talks about ‘s been around for over 31 decades, so that as a team, i have a great collective full of generations of experience regarding the gambling on line community. I very carefully and expertly view all of the online casino and you will suggest merely the best and most dependable metropolitan areas playing. This can be a familiar practice having greeting incentives, no-deposit incentives and you will free spins immediately put in an alternative player’s membership.

Manage take a look at HL Financial’s current repaired put promotion; HL Bank get modify cost any time at the their discretion. A trustee just who currently handles more than five beneficiary faith deposit account for the very same trust that have $250,one hundred thousand for each and every faith, will need to move certain membership to some other bank to be sure FDIC insurance coverage often include those people makes up about totals more $1.5 million. As we review to your 2023, the new nervousness i thought once we watched several banking companies fail more a few weeks have a tendency to stick in our memories. The security in our bank places is frequently taken for granted. But more those people few weeks, even those people as opposed to high balance inside their bank account wished to understand more info on just how its tough-made money is secure is always to their bank become insolvent. The fresh FDIC has created useful information to help bankers provide depositors having direct information on put insurance coverage.

What’s Happening Inside the Financial? Trick Takeaways

The fresh FDIC contributes with her the new balance in all Unmarried Membership owned from the exact same person in one financial and you can makes sure the newest soon add up to $250,one hundred thousand. The new FDIC is also now consolidating two categories of trusts — revocable and you can irrevocable — to the you to group. The newest FDIC is a different government agency which had been produced by Congress following High Depression to help heal trust within the U.S. banking companies.

All the details inside brochure will be based upon the newest FDIC regulations and you may laws in essence from the guide. The net type of so it pamphlet will be updated quickly if the rule change impacting FDIC insurance rates are designed. That it brochure will bring first information about the sorts of profile you to is actually covered, publicity constraints, and exactly how the brand new FDIC makes sure your bank account if the lender fails.

UOB repaired put rates

Generally, for each proprietor out of a rely on Membership(s) try covered as much as $250,100 per unique (different) eligible beneficiary, to a total of $step one,250,100 for five or higher beneficiaries. A confidence (sometimes revocable otherwise irrevocable) must see all of the pursuing the requirements getting insured below the brand new believe accounts group. Because the FDIC’s circulate is meant to make insurance policies laws for believe accounts simpler, it could push certain depositors over FDIC restrictions, considering Ken Tumin, maker away from DepositAccounts and you may older industry expert from the LendingTree. A no-deposit extra lets you enjoy real cash gambling games instead the currency. Regardless of where you are in the usa, you might claim a no-deposit added bonus in the several casinos on the internet today. For individuals who’re also a consistent customer, you’ll just be able to get a performance from 2.40% p.a good.

The newest getting institution does not have any duty to keep either the new hit a brick wall lender rates otherwise regards to the fresh account contract. Depositors away from a were not successful bank, but not, have a choice of both establishing another membership for the getting business otherwise withdrawing particular otherwise each of their financing instead of penalty. The newest FDIC adds with her all the specific senior years profile belonging to the brand new exact same person in one bank and you will guarantees the full upwards to $250,100000.